In Monday’s stock market update, the Dow Jones Industrial Average dipped by 0.22%, while the S&P 500 made marginal gains and the Nasdaq Composite continued its winning streak. Notably, the small-cap Russell 2000 turned negative for the first time in 2023, reflecting challenges among smaller businesses. Rising bond yields, with the 10-year Treasury yield reaching its highest level since October 2007, influenced the market’s performance. The US dollar also gained strength, driven by higher interest rate commitments and divergence in Purchasing Managers’ Index (PMI) data between the US and Europe. Risk aversion and declining oil and copper prices further supported the dollar’s rise, impacting currency markets. Looking ahead, key data releases will continue to influence market dynamics.

In the stock market update, on Monday, the Dow Jones Industrial Average experienced a 0.22% decline, closing at 33,433.35 points. This dip occurred despite a short-term agreement reached by U.S. legislators to prevent a government shutdown. The S&P 500, on the other hand, saw marginal gains of 0.01%, finishing at 4,288.39 points, while the Nasdaq Composite had a more positive day, adding 0.67% to reach a closing value of 13,307.77 points. Notably, this marked the fourth consecutive day of gains for the Nasdaq. However, the Russell 2000, a small-cap index, suffered a 1.6% decline on Monday, resulting in a year-to-date decrease of 0.3%. This marked the first time in 2023 that the Russell 2000 turned negative, reflecting challenges among smaller businesses. The Russell 2000 is often regarded as a valuable indicator of the overall economy’s health due to its focus on small enterprises.

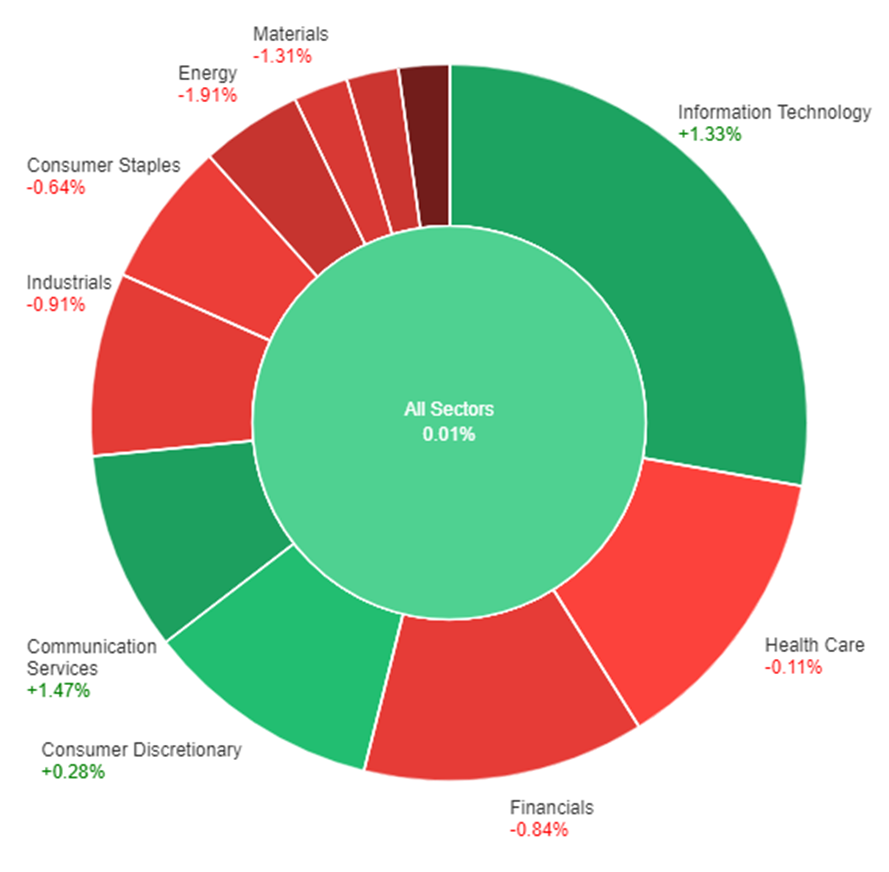

The market’s performance occurred against the backdrop of rising bond yields, with the 10-year Treasury yield reaching a high of 4.7%, its highest level since October 2007. In terms of individual stock movements, Discover emerged as the top gainer in the S&P 500, with its shares rising by nearly 5%. Medical device manufacturer Insulet saw a 3.5% increase in its stock value, while chipmaker Nvidia rose by almost 3%. Among the various sectors, technology, communications services, and consumer discretionary were the only ones that recorded positive gains. Communication services added 1.5%, the tech sector traded 1.3% higher, and consumer discretionary gained 0.3%. The Senate’s recent passage of a continuing resolution, signed into law by President Joe Biden, ensured that the government would remain open until mid-November. Historically, stock markets have shown little concern for government shutdowns, with the S&P 500’s performance during such periods remaining relatively flat. Analysts emphasized that other economic conditions, such as housing, manufacturing, and labor, are more critical factors to watch as the year progresses.

Data by Bloomberg

On Monday, the performance of various sectors in the market showed mixed results. The overall market, represented by “All Sectors,” had a minimal increase of 0.01%. Notable gainers included Communication Services (+1.47%) and Information Technology (+1.33%), which experienced significant positive growth. On the other hand, some sectors faced losses, with Utilities being the most affected, plummeting by -4.72%. Real Estate (-1.75%), Energy (-1.91%), and Materials (-1.31%) also saw substantial declines. Additionally, Health Care (-0.11%), Consumer Staples (-0.64%), Financials (-0.84%), Industrials (-0.91%), and Consumer Discretionary (+0.28%) experienced relatively smaller fluctuations in their values.

In the opening of the fourth quarter, the US dollar demonstrated resilience and strength, marking a 0.6% rise in the dollar index. This surge was primarily driven by an uptick in Treasury yields following the temporary resolution of a suspected US government shutdown. Additionally, the divergence in Purchasing Managers’ Index (PMI) data between the US and Europe favored the US dollar. The robust performance of the US currency was further supported by a commitment from Federal Reserve speakers to maintain higher interest rates for an extended period. This, in turn, triggered risk aversion, causing high-beta currencies like the Australian dollar and South African Rand to weaken. The dollar’s upward momentum was also aided by declines in oil and copper prices, which prompted derisking flows, alongside rising yields across Europe. As a result, the EUR/USD pair experienced a 0.76% decline, though it managed to hold above key support levels, raising questions about the sustainability of a recent rebound.

Looking ahead, the US dollar’s performance is expected to hinge on several key data releases, including the US JOLTS report, the ISM non-manufacturing data, and the employment report scheduled for Friday. Notably, the ISM manufacturing data exceeded expectations, while prices paid decreased, which might influence the dollar’s direction. In the currency market, USD/JPY saw a 0.27% increase, approaching the psychologically significant 150 level. Market participants are closely monitoring this level, as it is seen as a potential trigger point for intervention by the Japanese Ministry of Finance (MoF). The BoJ’s discussions on policy normalization are anticipated to be more active in Q1 2024, coinciding with wage negotiations, while the bank recently announced additional Japanese Government Bond (JGB) purchases in response to rising yields, which are nearing the bank’s 1% hard cap. Meanwhile, the British pound experienced a 0.79% decline, reaching its lowest point since March, due to a combination of risk-off sentiment and disappointing UK PMI data.

EUR/USD Drops Below 1.0500 Amid Strong US Dollar and Resilient Economic Data

The EUR/USD pair experienced a substantial decline, falling below 1.0500 as the US Dollar maintained its strength due to global risk-off sentiment and rising yields. The US Dollar Index (DXY) edged closer to 107.00, supported by positive economic data and Federal Reserve officials’ comments on the economy’s resilience. Meanwhile, the Eurozone reported a drop in unemployment and a confirmed Manufacturing PMI reading. The coming week’s key events, including the JOLTS and ADP reports, along with the Nonfarm Payrolls data, will likely influence the future direction of the EUR/USD pair, with the US Dollar’s strength hanging in the balance.

According to technical analysis, EUR/USD moved lower on Monday, reaching the lower band of the Bollinger Bands. It is currently trading above the lower band, suggesting the potential for further losses. The Relative Strength Index (RSI) is at 29, indicating that EUR/USD is now in bearish bias.

Resistance: 1.0538, 1.0605

Support: 1.0406, 1.0326

XAU/USD Hit Multi-Month Low Amid Shifting Economic Tides and Strong US Dollar Demand

Spot Gold recently plunged to a multi-month low of $1,827.11 per troy ounce, primarily driven by resurging US Dollar demand. Encouraging economic data from China and the United States initially boosted sentiment, with China’s Producer Manager Indexes indicating economic resilience and the US Congress extending the debt ceiling to avoid a government shutdown. However, as the day progressed, market sentiment turned sour due to global economic struggles, despite some positive signs such as an improvement in the US ISM Manufacturing PMI. Rising government bond yields, with the 10-year Treasury note hitting its highest since 2007, fueled demand for the US Dollar.

According to technical analysis, XAU/USD moved lower on Monday, creating downward pressure on the lower band of the Bollinger Bands. Currently, the price is consolidating above the lower band, suggesting potential consolidation for today. The Relative Strength Index (RSI) is currently at 13, signifying a bearish bias for the XAU/USD pair.

Resistance: $1,834, $1,858

Support: $1,809, $1,777

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Cash Rate | 11:30 | 4.10% |

| AUD | RBA Rate Statement | 11:30 | |

| CHF | CPI m/m | 14:30 | 0.0% |

| USD | JOLTS Job Openings | 22:00 | 8.81M |