Market Focus

After the White House’s chief medical adviser, Dr. Anthony Fauci, eased concerns about the severity of the new Covid-19 virus, Wall Street decided to put aside omicron’s concerns on Monday. Besides, there are reports that China is considering easing its monetary policy. In terms of Fed policy, the latest report indicates that the central bank may announce its plan at the next meeting to withdraw from the bond purchase plan more quickly.

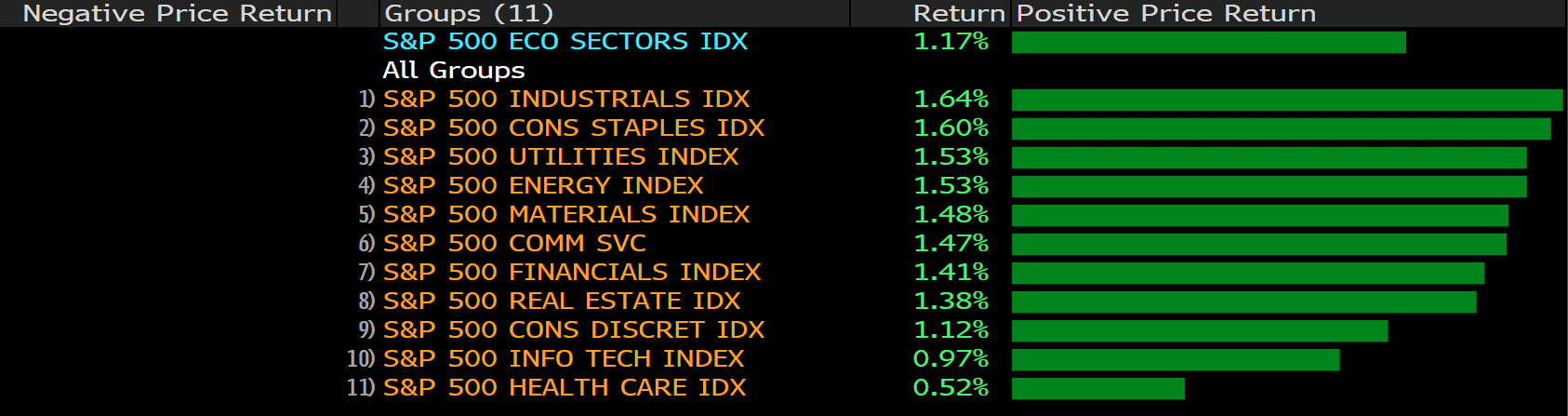

The Dow Jones Industrial Average rose 646.95 points to 35,227.04 points, the S&P 500 index rose 1.17% to 4,591.68. The Nasdaq Composite Index, which is dominated by technology stocks, rose 0.9% to 15,225.15 points.

With the news that the epidemic has eased, the aviation industry finally rebounded on Monday.

The American Airlines Group rose 7.9%, US Global Jets exchange-traded fund rose 5.3% and United Airlines Holdings rose 8.3%. Moreover, the post-pandemic reopening stocks have also achieved good results, the Carnival and Royal Caribbean Cruises rose 8.0% and 8.3%, respectively. Marriott International rose 4.5%, Live Nation Entertainment rose 6.1%, and Cinemark Holdings rose 7.7%. However, in the technology sector, not as strong as other sectors, Apple rose more than 2% on Monday, while Microsoft fell 0.3%, and the leader in electric vehicles, Tesla, fell more than 5%.

Main Pairs Movement:

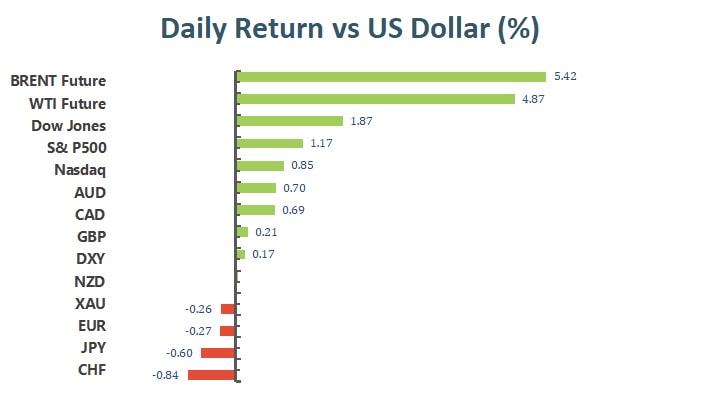

The U.S. dollar closed mixed on Monday. On Friday, the United States released a Nonfarm Payrolls report, which was lower than market expectations and raised doubts about further aggressive reductions in the US.

Regarding the Omicron coronavirus variant, although the virus is still spreading in many countries and communities, at the same time, there have been no deaths related to this variant so far, which raises people’s hopes for a milder illness to prevent lockdowns and restrictions, and this also avoid an economic slowdown.

The euro is one of the weakest opponents of the US dollar, closed at 1.1265 against the greenback on Monday. High-yield currencies rose slightly, with GBP/USD rising 0.23% to close at 1.32624. On the other hand, commodity-related currencies rose the most, Aussie up 0.8% and CAD went up 0.62% against the dollar. The yen and Swiss franc fell slightly due to weakening concerns, but all major currency pairs remained within familiar levels.

Gold fell slightly and closed at $1,778 per troy ounce. On the other hand, crude oil prices rose sharply with the stock market, and WTI closed at $69.70 per barrel and Brent oil closed at 73.64, both up 5%.

Technical Analysis:

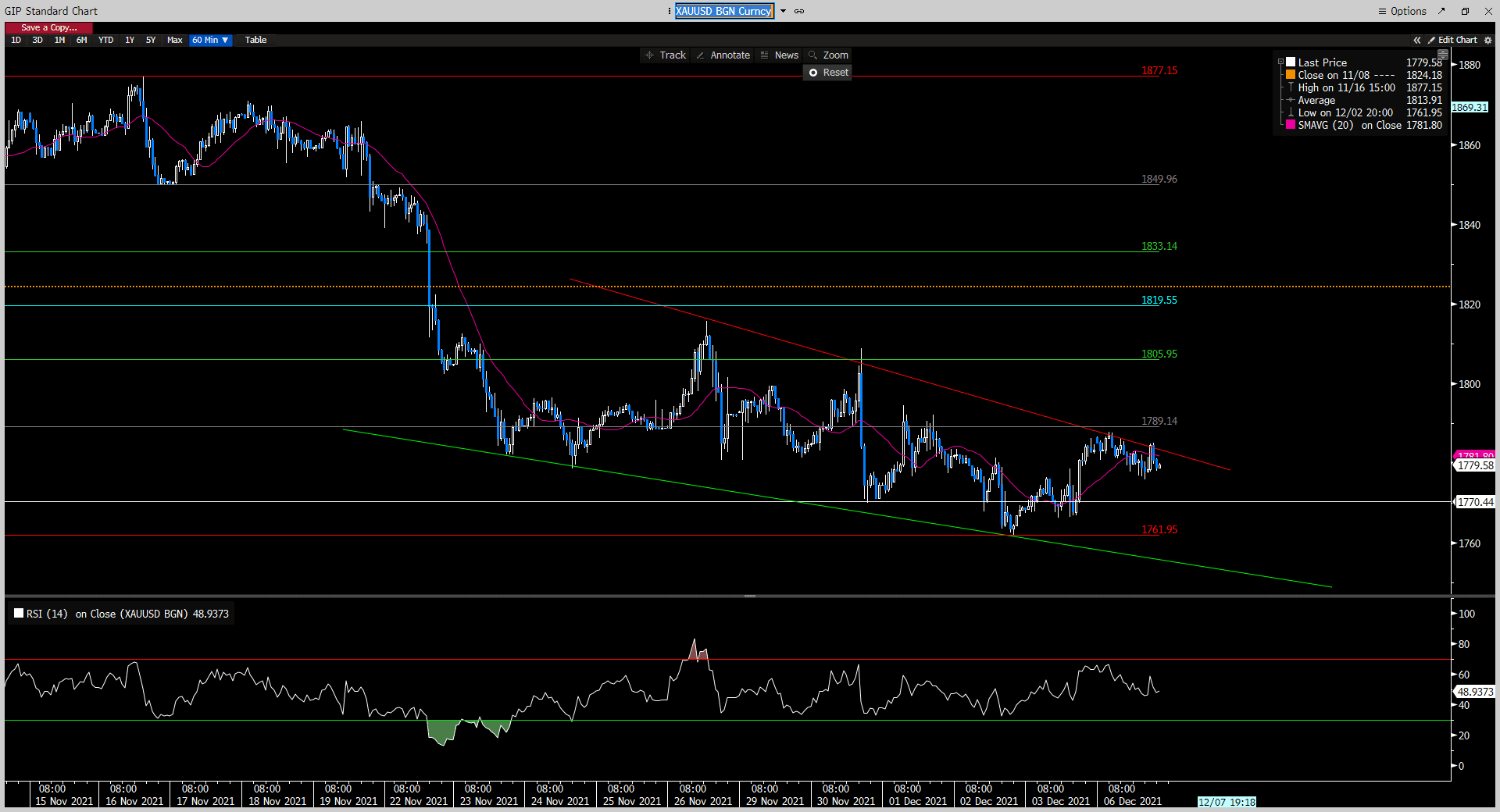

The outlook of the precious metal, Gold, remains subdued as it continues to fall within the descending channel. However, today’s bulls seems to push gold upside, toward its immediate hurdle at $1,789 and the edge of the descending trendline. Gold looks to hover around $1,780 recently as the RSI is currently neutral, setting at the 50th mark. To the upside, gold needs to breach the descending line and the 60 days- simple moving average in order to regain bullish momentum. On the contrary, if gold fails to break through the barrier, then it is expected to head toward the next support at $1,770.

Resistance: 1,780, 1,797, 1,808

Support: 1,770, 1,761

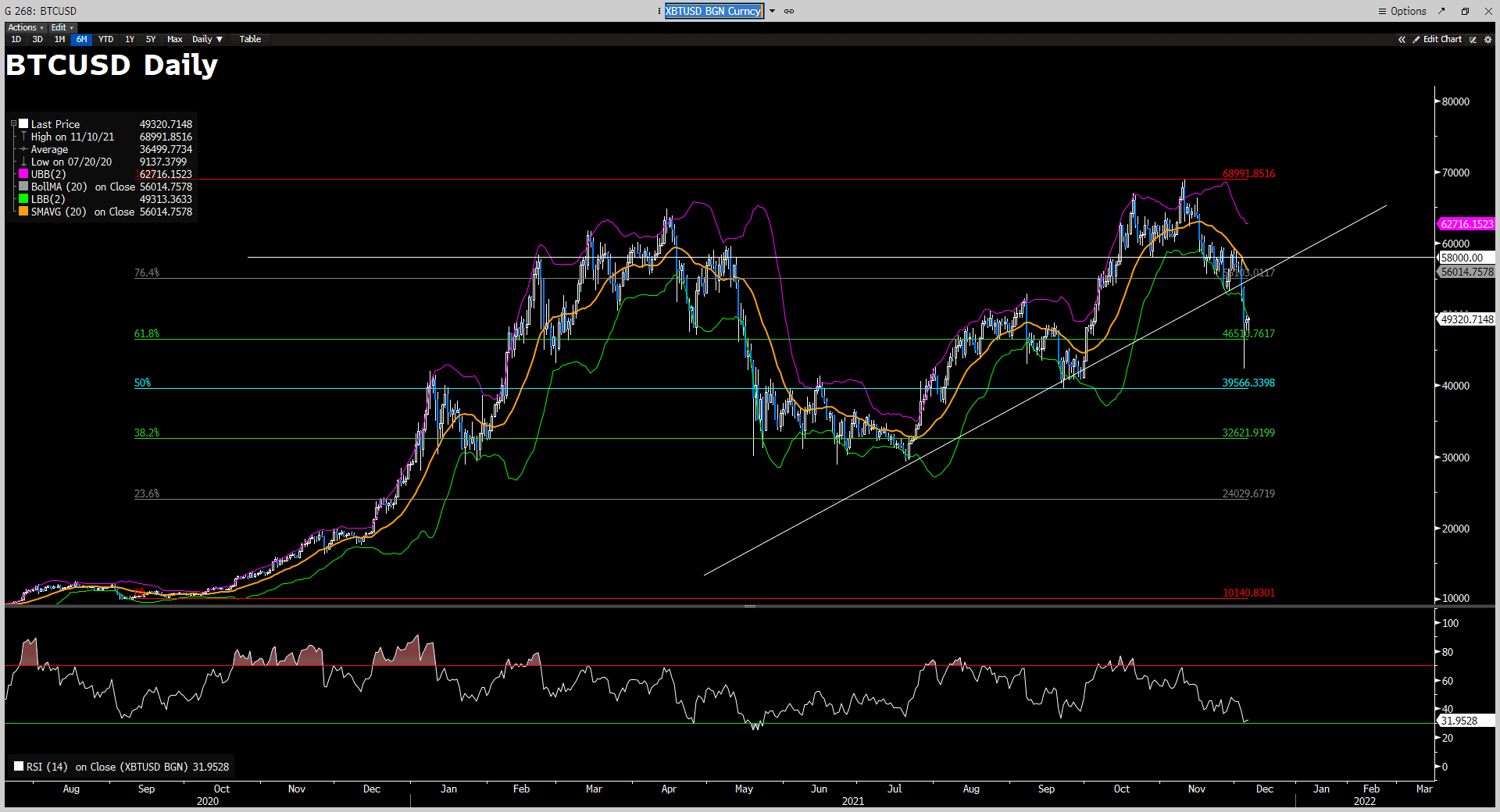

Bitcoin bounces back and stands nearly $50,000 after a devastating weekend, tumbling more than 17%. From the technical perspective, the support around $49,000 looks steady and robust, Bitcoin’s bearish momentum stops here as the time of writing. The outlook of Bitcoin turns bearish on the daily chart as it has breached the ascending trendline. To the upside, Bitcoin needs to climb above the acceptance level of $55,103 to regain strength. As the time of writing, Bitcoin looks to rebound as the RSI has reached the oversold territory, which is due to a pullback. To the dowside, if the current support at $46,530 fails to hold, then Bitcoin is expected to head toward the next support at $39,566.

Resistance: 55,103, 58,000, 68,991

Support: 46,530, 39,566, 32,621

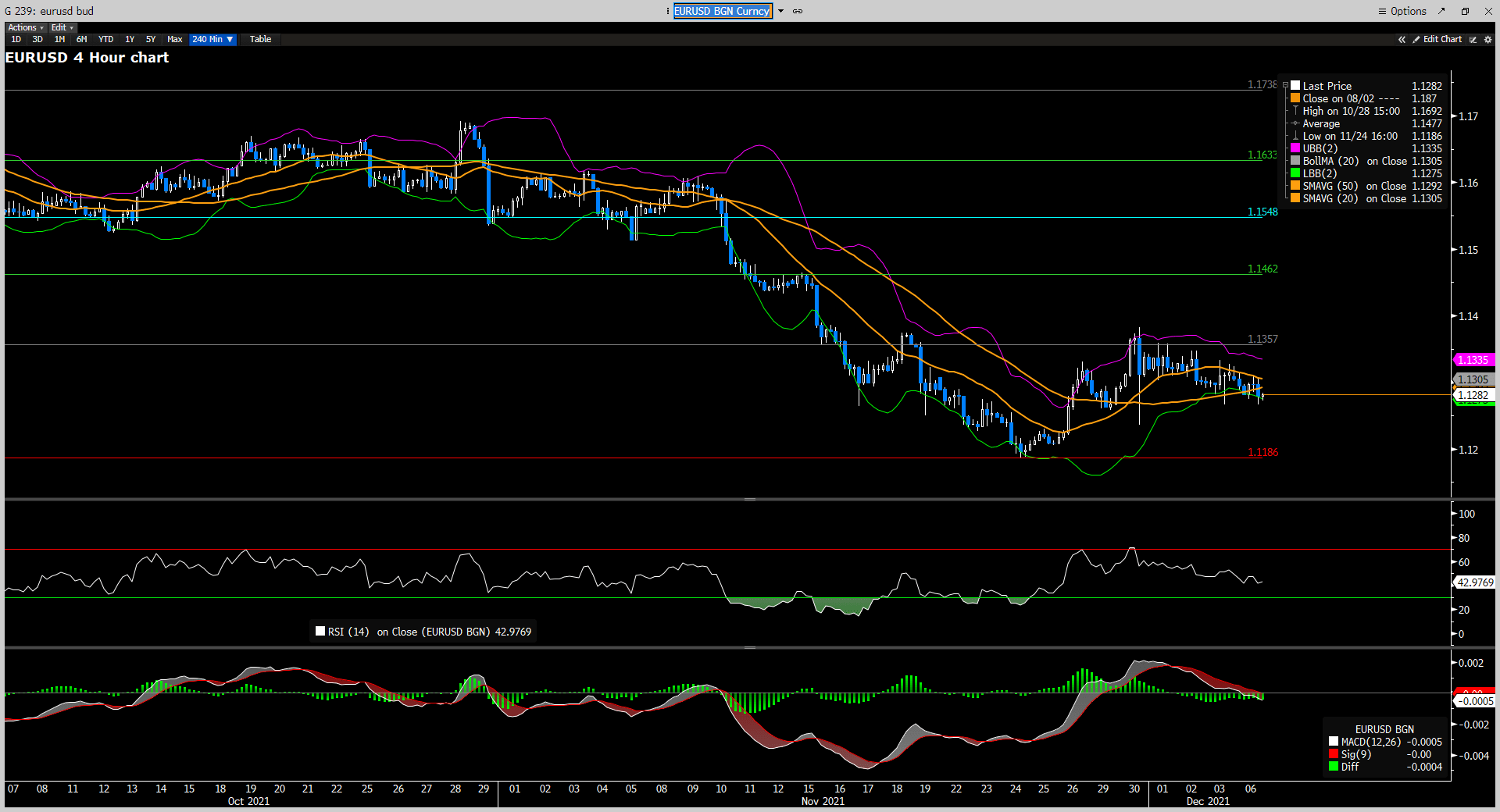

EURUSD trades below 1.1300 as the US dollar is comparably stronger. From the technical aspect, the outlook of EURUSD remains bearish on the 4- hour chart after meeting sellers around the resistance level at 1.1357. In the meantime, EURUSD continues to fall within the descending channel while it falls below its simple moving averages. It is expected to see the pair consolidates in the range from 1.1357 and 1.1.1186 as the RSI is currently in the midline, suggesting a directionless within negative levels and maintaining the risk skewed to the downside.

Resistance: 1.1357, 1.1462, 1.1548

Support: 1.1186

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

GBP |

BRC Retail Sales Monitor (YoY) (Nov) |

08:01 |

N/A |

||||

|

GBP |

Halifax House Price Index (MoM) (Nov) |

15:00 |

N/A |

||||

|

GBP |

Halifax House Price Index (YoY) |

15:00 |

0.8% |

||||

|

USD |

Exports |

21:30 |

N/A |

||||

|

USD |

Imports |

21:30 |

N/A |

||||

|

USD |

Nonfarm Productivity (QoQ) (Q3) |

21:30 |

-4.9% |

||||

|

USD |

Trade Balance (Oct) |

21:30 |

-66.80B |

||||

|

USD |

Unit Labor Costs (QoQ) (Q3) |

21:30 |

8.3% |

||||