Notification de mise à niveau du serveur – Feb 06 ,2026

Cher client, Dans le cadre de notre engagement à fournir le service le plus fiable à nos clients, une maintenance …

Retour

Retour

Dear Client,

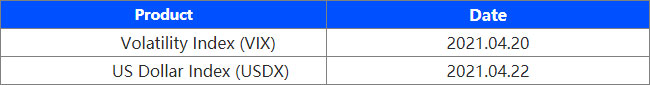

Due to the changes made by our liquidity provider, we will cease to offer Volatility Index (VIX) Cash and US Dollar Index (USDX) Cash, and change the asset class from Cash to Futures.

The dates of contract switching are as follows:

What will happen to my open positions?

Any open positions on Volatility and US Dollar Index Cash will then be held on an expiration and futures basis.

Adjusted Volatility and US Dollar Index Futures positions will then NOT be subjected to overnight financing charges, and instead be subjected to rollover adjustment if you hold over the monthly expiration date, appearing on your statement as “Cash Adjustment-Rollover”.

What is the rollover?

The concept of the rollover is switching the expiring contract to a new contract prior to expiration without asking clients to close their position.

The rollover adjustment does not eliminate the associated market risk between the market close and the market re-open of the rollover date.

What can I do to avoid rollover adjustment?

To avoid rollover adjustment, you may choose to close any Volatility and US Dollar Index open positions you many have in your account before the contract switching this time and a day prior to any of the following expiration dates.

Thank you for your patience and understanding with regard to this important initiative.

If you’d like more information, please don’t hesitate to contact trading@vtmarkets.com.

Le trading de CFD comporte un niveau de risque élevé et peut ne pas convenir à tous les investisseurs. L'effet de levier dans le trading de CFD peut amplifier les gains et les pertes, dépassant potentiellement votre capital initial. Il est crucial de bien comprendre et reconnaître les risques associés avant de négocier des CFD. Tenez compte de votre situation financière, de vos objectifs d’investissement et de votre tolérance au risque avant de prendre des décisions commerciales. Les performances passées ne préjugent pas des résultats futurs. Reportez-vous à nos documents juridiques pour une compréhension complète des risques liés au trading de CFD.

Les informations contenues sur ce site Web sont générales et ne tiennent pas compte de vos objectifs individuels, de votre situation financière ou de vos besoins. VT Markets ne peut être tenu responsable de la pertinence, de l'exactitude, de l'actualité ou de l'exhaustivité de toute information du site Web.

VT Markets n'offre pas ses services aux résidents de certaines juridictions, y compris, mais sans s'y limiter, les États-Unis, Singapour, l'Inde, la Russie et toute juridiction répertoriée par le Groupe d'action financière (GAFI) ou soumise à des sanctions internationales. Les informations sur ce site web ne sont pas destinées à être distribuées ou utilisées par toute personne ou entité dans toute juridiction où une telle distribution ou utilisation serait contraire aux lois ou réglementations locales.

VT Markets est une marque avec plusieurs entités autorisées et enregistrées dans diverses juridictions.

· VT Markets (Pty) Ltd est un fournisseur de services financiers (FSP) agréé enregistré et réglementé par la Financial Sector Conduct Authority (FSCA) d'Afrique du Sud sous le numéro de licence 50865.

· VT Markets Limited est un courtier en investissement agréé et réglementé par la Mauritius Financial Services Commission (FSC) sous le numéro de licence GB23202269.

VT Markets Ltd, enregistrée en République de Chypre sous le numéro d'enregistrement HE436466 et dont le siège social est situé à l'Archevêque Makarios III, 160, étage 1, 3026, Limassol, Chypre, agit uniquement en tant qu'agent de paiement pour VT Markets. Cette entité n'est ni autorisée ni agréée à Chypre et n'exerce aucune activité réglementée.

Copyright © 2026 Marchés VT.

Bonjour 👋

Bonjour 👋

Scannez le code QR avec votre smartphone pour démarrer un chat avec nous, ou cliquez ici.

Vous n’avez pas l’application ou la version de bureau de Telegram installée ? Utilisez plutôt Telegram Web .